How Dennis, an upcoming Financial Services Manager uses 360-HappiU® to recruit and empower new advisors

Image source: Andrew Grossman, Cartoonresource.com

Editor’s notes: Dennis is an upcoming Financial Services Manager who leverages a scoring tool and system called 360-HappiU® to initiate and empower new advisors.

What are some of the demographic profiles of your incoming advisors?

Most of them are in the range of early twenties to mid-thirties. I pick this age range as I understand how to engage them.

How do you use the scoring system to support your advisor recruitment?

The scoring system makes things intuitive. My prospect advisors can envision themselves using the system easily. The scoring system can be used to pre-engage the client prospects – this is especially useful for new advisors who are intimidated by the idea of a sales appointment ….

Watch A MDRT Member, Padrick, Open Investment Cases With 360-HappiU®

Editor’s note: Padrick is an accomplished financial advisor who qualified for Million Dollar Round Table (MDRT). He uses a scoring system called 360-HappiU® to help customers self- discover their financial future and embark on their investment journey.

Share with us your career achievements so far?

I achieved Million Dollar Round Table (MDRT) last year. This means that I am among the top 10% in the financial advisory industry.

Congratulations! Now that you have marked a milestone for yourself, what’s the next sales challenge you want to overcome?

My biggest challenge is to help my prospects see the value in meeting up with me! In this day and age, people tend to think you have an agenda, even if they are your clients ….

How A Financial Advisor, Wendy Get Customers Acknowledge & Tackle Their Financial Challenges

Editor’s note: Wendy is a financial advisor with three years of experience. She uses a scoring system called 360-HappiU to get customers to acknowledge and tackle their financial challenges.

How long have you been a financial advisor?

I joined at the height of the COVID-19 pandemic. I left my corporate job and became a financial advisor because I wanted to be on the ground to interact and help.

Do you use the financial satisfaction scoring system to support your customers?

Yes, every 1 in 2 of my customers would volunteer to score themselves on their financial satisfaction. Most of them explore retirement and saving as their financial priorities ….

How 360F tackles behavioural biases

to support insurance sales

If you are responsible for insurance sales, you must understand behavioural biases. They give you hints on how to increase sales. In the best interest of your customers, of course.

Editor’s Notes: We launch this article on a significant day – International Women’s Day. In the spirit of #breakthebias, we include an epilogue where we put a critical eye on gender differences in behavioural biases.

360F explains how ignoring behavioural biases impedes advisory effectiveness but actively acknowledging their presence builds up a solid advisor-client relationship.

Loss aversion motivates us to buy insurance

The loss aversion bias is the most obvious and intrinsic motivation for people to buy insurance. Behavioural economists Daniel Kahneman and Amos Tversky describe this universal bias ….

How we make financial advisory authentic for

maximum business and customer value

Financial advisory is often misused as a means for product sales. From that perspective, poor advice is worse than no advice, as the former offers a false sense of security. Yet proper financial advisory is the gateway to productivity, in terms of sales conversion and case size.

360F addresses the inherent challenges of financial advisory and proposes alternative thinking to realize its authentic potential.

Challenge 1: Planning is hypothetical

Long-term planning inevitably involves assumptions such as inflation rates and investment returns ….

Case study: How Angeline, a financial adviser, overcomes her self-doubts with 360-HappiU®

Editor’s note: Angeline joined the financial advisory industry just one year ago, during the Covid-19 pandemic. Despite the daily uncertainties, she overcome her self-doubts by tapping on supporting services such as the 360-HappiU® developed by 360F.

1. How did you join the financial advisory industry?

The truth is, I didn’t plan to! I actually dreamt of being a cabin crew! But that fell through during the pandemic. The pandemic also forced me to relook into my family’s financial portfolio, and that sparked my interest in financial planning.

2. .. And what is your biggest struggle?

I often have moments of self-doubt. This makes it hard for me to spontaneously advise my customers ….

The problem with customer engagement

and how we solve it

Customer engagement refers to the connection between companies and customers that influences purchasing behaviour [1] Gallup research shows that such a connection is built partly on rational loyalty but mostly on emotional attachment. It demonstrated that a mid-size bank could add $265 million to its customer deposits just by scoring on higher attachment from 50,000 more customers [2].

Following this definition, 360F tackles insurers and advisors’ challenges in customer engagement, and proposes alternative thinking.

Challenge One: Campaigns are blue-ticked

Insurers and advisors use product-centric campaigns as touchpoints, differentiating themselves with product benefits to get consumers’ attention ….

Case study: How an introverted advisor uses HappiU®

Editor’s note: Don is a financial advisor representative with two years of financial advisory experience. He’s a satisfied client of 360F and enjoys using their scoring tool called 360-HappiU®. He happens to be an introvert.

1. As a financial advisor representative, what gets you excited?

Leads, leads, and more leads! The possibility of having a steady stream of warm leads, ready to purchase, gets me fired up.

2. .. and what keeps me awake?

The nagging question is ….

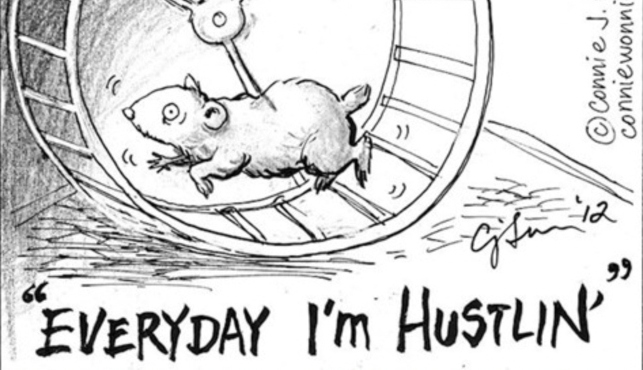

When the hamster says "Carpe diem"

Time warp just happened. You’re actually in a Zoom video call with your future self. After making a mental note to apply sunscreen from now on, you can’t help but ask,

“Are you living the life we have always wanted?”

Your future self glares at you.

You are confused. Haven’t you been hustling hard for your dreams? Haven’t you lived by “Carpe diem”, making every day count?

But doing things again and again in the same fundamental way is akin to a hamster running on a wheel. You’re moving but not progressing, stuck in stagnation.

Your future self flies into a flurry of complaints, until you interrupt.

“Are you happy?”

Your future self pauses.

“It’s not perfect, but this is not the last future.”

Your future self might make wiser decisions through trials and tribulations. However, do you really want your future self to go through the learning pains? One should not underestimate the financial impact.

“Seize the day, trust in the future as little as possible.”

You might learn from experience by risking a financial mistake, but is the risk necessary? Pick scientifically robust forecasting tools such as 360-HappiU® to help you assess your current chances of living the future you want. Use a complementary and reliable navigation tool, such as 360-ProVestment®, to give you the optimal plan and re-plans so that you are always set for the maximum chance of living that future. In addition, have a neutral companion who knows you well enough and is close enough to give honest and constructive feedback that forwards you.

And remember the sunscreen.

Discuss more?

Drop us an eMail here: clarie.kwa@360f.com

Would you attend Warren Buffet’s Masterclass on financial advisory?

With 1.5 million subscribers, Masterclass is all the rage recently. Popularized by personalities like Gordon Ramsay and Serena Williams, demand surged 1000% during the pandemic. From cooking to tennis, Masterclass offers budding learners an online learning experience with a veiled promise of achieving the same level of expertise if they apply what they have learnt.

Imagine this: What if Warren Buffet gives a Masterclass on your financial matters? With a net worth of $100 billion, it would seem natural for one of the world’s top billionaires to teach all things finance-related, ranging from insurance to investment. Warren Buffet’s Masterclass, if it exists, would be especially illuminating for people looking to achieve even a fraction of his wealth.

While we are not sure when and if Warren Buffet would give a Masterclass, the public has no lack of options when it comes to investor education, be it a broad overview or a discovery of some unconventional financial instruments. We are in the age of “financial wokeness”.

“The most dangerous man is one who’s read only one book”

Financial wokeness feels like financial enlightenment as one self-discovers (or do they?) the way to financial freedom and satisfaction. However herein lies the danger of being lulled into believing that what works for others will work for you.

One man’s meat is another’s poison

Laurence Peter, a professor from the University of Southern California, explained the fundamental challenge of advice “If people can differentiate between good advice and bad advice, they don’t need advice.”

Without the means to tell good advice from bad advice, these courses, even if delivered by renowned figures, may backfire as everyone’s financial circumstances and personal needs and aspirations are different. Good advice for one is irrelevant, and at worst, disastrous, for another.

Good advice must be testable. The method or metric to test financial advice must be personalized or it risks being irrelevant or misleading. For example, financial advice from early-retirement proponents will be a mismatch for someone who is not looking for early retirement because they enjoy their work.

So, who will you learn from?

If financial advice from top billionaires may not be relevant, what about learning from someone closer to home, like your mum?

Mums are often known for their razor-sharp instincts that tell them when their children are happy or hungry. They have a good sense of their children’s preferences and aspirations. Nonetheless some mums are less attentive than others. Their personal opinions tend to loom over the relationships too.

If financial advice from humans are potentially biased, what about learning from something even closer to us: mobile apps. As mobile apps are used ubiquitously, personal finance apps, integrated with self-help planning functions, that aggregates personal financial information are surging in popularity. For example, Mint provides insights (Mintsights) and even subscription-cancellation automation to help the layperson reduce spending [1]. However Mint does not assess the layperson’s financial satisfaction, a subjective state guided by his or her ability to fulfil the multiple needs and aspirations in line with preferences such as standard of living and tolerance towards uncertainty. By excluding financial satisfaction, financial advice is reduced to a sterile list of to-do’s, and paradoxically, becomes even more impersonal.

So, who would you take financial advice from? The billionaire, your mom, or an app?

HappiU®: the personal coach

At 360F, we take the best of these options and combine them. We innovate 360-HappiU®, a scoring system that scores your financial satisfaction that works in tandem with our solutioning optimizer.

Beyond typical financial apps like Mint, we don’t just aggregate and compare the best insurance and investment products to buy. Instead, we put together life insurance and investment products in the form of optimized and holistic solutioning bundles, each auto-configured uniquely for every customer.

Important is that we build our model on the back of the Nobel Prize-winning research in behavioural economics. This enables us to make advice testable and measurable by forecasting the customer’s financial satisfaction before and after applying the financial advice. Above all, 360-HappiU® provides real-time financial coaching insights that address one’s personal preferences and priorities, motivating individuals to put their financial happiness at the forefront.

In the age of financial awakening, the layperson should not be left to sift blindly through the cacophony of financial information out there. By using technology to merge expertise and intuition with an added personal touch, self-verifiable financial advice is within reach and the layperson can be the most financially satisfied version of themselves.

Discuss more?

Drop us an eMail here: clarie.kwa@360f.com

Notes

[1] https://mint.intuit.com/blog/empowermint/mintsights-advice/