Overview

360-PortfolioAnalytics® is an investment portfolio servicing solution for advisors. Give advisors timely reports to help them help customers spot danger and opportunities. Go from data to decisions with speed and confidence.

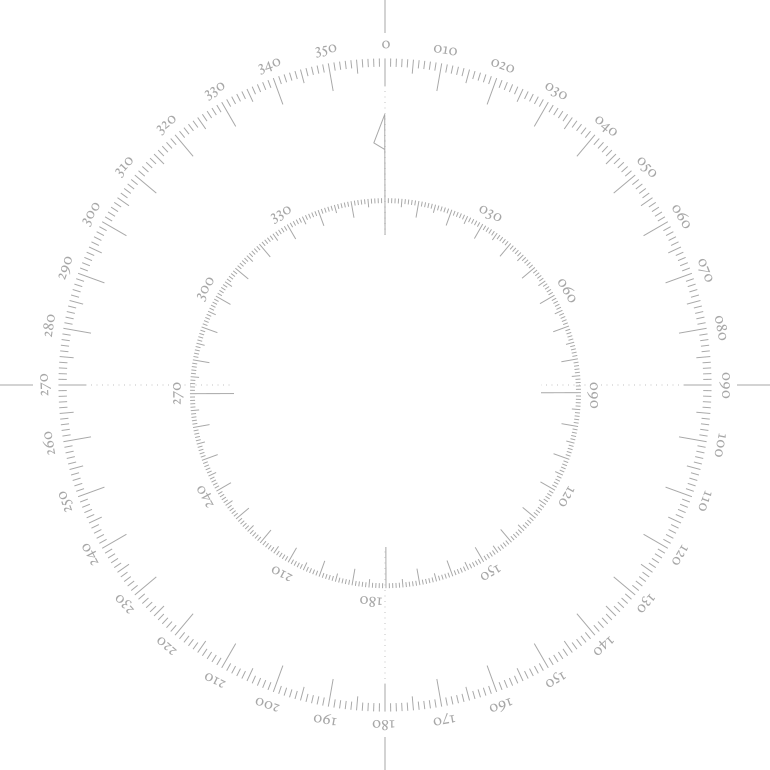

Triangulate Historical Data For Insights

Evaluate historical performance top-down and bottom-up at the levels of the funds, portfolios and benchmarks

Simulate

Portfolio’s Future Performance

Use the built-in simulation flexibility to challenge assumptions when planning for top-ups and withdrawals

Run Multivariate Risk Exposure Analysis

Analyse portfolio exposure from all angles, be it geography, asset or even ESG risk ratings, against customer’s tolerance

Use API With Data Visualization Features

Integrate in intermediated or direct-to-consumer journeys so that advisors can service with regular visual reports

Use Case Examples

Highlight The

Unplanned Need

Having portfolio value information siloed away from insurance holdings deprives customers of holistic optimization benefits. Use with 360-ProVestment® to keep loved ones well-protected and dreams on track.

Compare

Alternatives

Knee-jerk reactions and herd mentality are the bane of every investor. Offer advisors and their customers unambiguous and immediate feedback loop to keep rationality in check

Unleash Richer Experience!

Combine 360-PortfolioAnalytics® with other 360F API services. For example, use with 360-Sentiments® to service your investing customers with relevant touchpoints. Show them not only their rebalancing needs but also macroeconomic opportunities.