The Day of a productive Financial Advisory Professional

David is a financial advisor. While his peers begin their day with cold calling and emailing the latest product campaigns, David invites his prospects to complete a simplified financial self-discovery exercise at their own pace. David pre-empts them that the exercise gifts them a scoring mechanism that measures their likely financial satisfaction in the hope of achieving future financial independence.

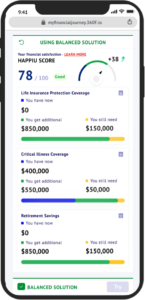

The score calculated by the mechanism, is known as the HappiU. It is a transparent metric that reflects the prospect’s ability to weather through a financial crisis like critical illness and yet achieve his/her financial goals. It also measures the impact of any suggested financial advice.

The HappiU score is central to trust building in the advisory relationship. Just like how the navigation software enables us to trust strangers to bring us to our destination in their private hire cars, the HappiU score ensures both the prospect and the advisor share the same referencing system that is intuitively and mutually understandable. A prospect empowered to understand and discuss his current net worth and financial gaps is one who will develop buyer intent to improve his situation. Buyer intent fuels the advisor’s interaction with the customer. The stronger the intent, the easier it is for advisor to engage the prospect productively and bring customer satisfaction.

David’s day has a good start and gets even better. The self-discovery exercise generates a bundle of personalized and recommended insurance plans, and showcases how these insurance policies can improve the prospect’s HappiU score. This self-directed functionality gives prospects a sense of control. Unlike the boomer generation who readily accepts the expert authority of the financial advisor, the current millennial generation resists the monologue of information transfer from their financial advisors. By guiding prospects to discover the information and enabling them to understand it, advisors find themselves in an effective collaboration with their prospects to reach a consensus easily. The self-discovery financial exercise has not only empowered the prospect but also David to save the time which would otherwise be wasted on overcoming objections from prospects who have yet to develop any buyer intent.

Most customers want to be included in the decision-making but few will want to venture alone. David now spends most of his day guiding his prospects through the sales process. Seeing is believing but in the world of financial advice, advisors and prospects must grapple with unforeseen events. However, David has a visual financial simulator at his disposal, a powerful and credible foresight tool that analyzes and visualizes the prospect’s personal and market risks based on probability to project the lifetime net wealth. Using the tool, David demonstrates how the recommended insurance solutions enables the prospect to cope with bad times and achieve his defined financial goal of financial independence.

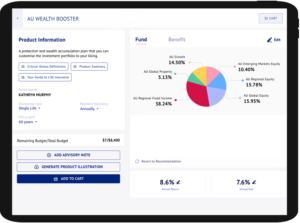

On some days, David encounters prospects whose true concerns surface only during an in-person or the insurance sales process. David is free to modify the recommendation options generated in the self-discovery exercise. Staying on the same platform, he customizes the solutions – from comparing different insurance and investment features in a single view, to configuring the individual insurance policies and simulating their impact on the prospect’s financial satisfaction. Also, he can take in his prospect’s special requirements such as Environmental, Social, and (Corporate) Governance (ESG) preferences and customize an optimal investment portfolio. As the platform helps David to stay within reasonable assumptions and suitability rules, he minimizes the chances of having to re-work his proposals or getting flagged for compliance issues during audits.

Supported by robust and intuitive automation tools, David relishes his career as a financial advisor. His sales success is sustainable. He enjoys interacting with his prospects and customers and the best part – the feeling is mutual.

Discuss more?

Drop us an eMail here: clarie.kwa@360f.com