Watch A COT Member Yan Hui Integrate Storytelling With 360-HappiU®

Image source: Marketoonist.com

Editor’s note: Yan Hui is a 2021 Court of Table (COT) qualifier. To keep up her sales excellence, she combines her skills with tools. One of them is a scoring system, 360- HappiU®, which she complements with storytelling techniques.

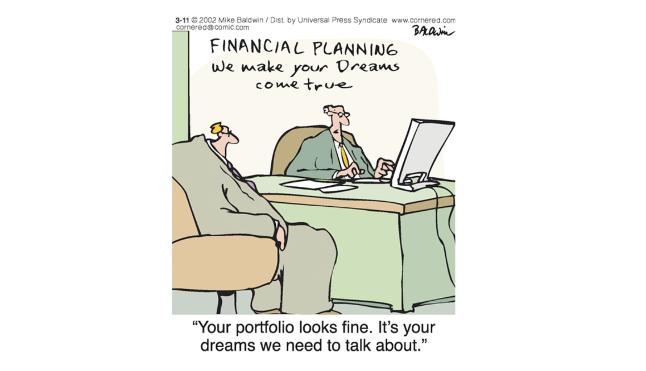

Share with us how you use the scoring system with your customers.

My customers are often interested to know their score as it gives them an instant grasp of their future financial wellbeing. This makes it easy for me to build rapport with them. I also incorporate some storytelling techniques to bring the score to life ….

Meet Joven, A Financial Advisor Who Qualifies His Gen Z Prospects With 360-HappiU®

Image source: Marketoonist.com

Editor’s notes: Joven uses a scoring system called 360-HappiU® to size up his Gen Z prospects.

How long have you been a financial advisor?

Two years

Who are your prospects?

My prospects are like me, from the Gen Z population. They want to assert their freedom to decide, even if it is as simple as meeting me ….

How Singapore can materialize its commitment to

holistic financial advice

.. and lead the world by example

Image source: Tedgoff.com

To elevate the professionalism of the financial advisory services sector, the Insurance Culture & Conduct Steering Committee (ICCSC) in Singapore released a best-practice paper on 11 April 2022:

“Customers’ negative feedback often centres on the lack of follow-ups, regular servicing and policy reviews from their FA Rep (Financial Advisor Representative). Customers typically This has led to customers’ reduced trust in their FA Rep…”

Check the servicing box?

Regular servicing and reviews are important but so is the quality of such activities ….

Does your Quote-And-Illustration system delight the customer?

Image source: Cartoonstock.com

Notorious for being the weakest link in life insurance product development, the illustration system is however a largely untapped source of customer experience.

According to McKinsey analysis1, customer-first businesses benefit in terms of more cross-selling success and positive referrals, and less marketing spend required to drive growth.

Such benefits are in the customers’ best interest where cost savings reach a sustainable scale and passed back as reduced premiums, ultimately helping to close the persistent and global protection gap.

Among the many ways to embed customer centricity in a life insurer’s value chain, 360F seeks out the one that has the most far-reaching impact – the illustration system ….

How inflation affects your customers' HappiU

Image source: Cartoonstock.com

We live in inflationary times. Average inflation has hit a record 7.5% in Europe1. In the US, the Federal Reserve hurries to reduce its balance sheet by $95 billion a month, tightening monetary policy to curtail the overshooting inflation2. Singapore, where 360F is headquartered, has experienced a near doubling of headline inflation3.

Trigger the servicing!

With rising prices, the customer’s purchasing power diminishes ….

The hardest people to sell to is family. Until a financial advisor used-360-HappiU®

Image source: Cartoonstock.com

Editor’s Note: Derwin is a newly minted financial advisor who uses a scoring system called 360-HappiU® to build trust with his family members.

How long have you been a financial advisor?

I joined the financial advisory industry last year, so I’m still relatively new to the advisory scene.

Which group of people do you find the hardest to reach out to?

The hardest group of people to reach out to is actually my family members, especially my relatives. They are very unwilling to share financial information with me so starting a conversation about financial planning is challenging ….

How 360F Tackles Behavioural Biases For Your Customer's Best Interests

Image source: Cagel.com

In Part 1 of the Behavioural Bias series, we address loss aversion and optimism biases, explaining how we manage them actively in our financial advisory applications.

In this follow-up article, we tackle another two biases, overconfidence and mental accounting, that we weed out as part of our optimization work for the customer’s financial well-being.

The Overconfidence Effect

Humans are terrible at judging probabilities. This incompetency triggers a couple of biases including the loss aversion bias, optimism bias and in no lesser degree, the overconfidence effect ….

How Dennis, an upcoming Financial Services Manager uses 360-HappiU® to recruit and empower new advisors

Image source: Andrew Grossman, Cartoonresource.com

Editor’s notes: Dennis is an upcoming Financial Services Manager who leverages a scoring tool and system called 360-HappiU® to initiate and empower new advisors.

What are some of the demographic profiles of your incoming advisors?

Most of them are in the range of early twenties to mid-thirties. I pick this age range as I understand how to engage them.

How do you use the scoring system to support your advisor recruitment?

The scoring system makes things intuitive. My prospect advisors can envision themselves using the system easily. The scoring system can be used to pre-engage the client prospects – this is especially useful for new advisors who are intimidated by the idea of a sales appointment ….

Watch A MDRT Member, Padrick, Open Investment Cases With 360-HappiU®

Editor’s note: Padrick is an accomplished financial advisor who qualified for Million Dollar Round Table (MDRT). He uses a scoring system called 360-HappiU® to help customers self- discover their financial future and embark on their investment journey.

Share with us your career achievements so far?

I achieved Million Dollar Round Table (MDRT) last year. This means that I am among the top 10% in the financial advisory industry.

Congratulations! Now that you have marked a milestone for yourself, what’s the next sales challenge you want to overcome?

My biggest challenge is to help my prospects see the value in meeting up with me! In this day and age, people tend to think you have an agenda, even if they are your clients ….

How A Financial Advisor, Wendy Get Customers Acknowledge & Tackle Their Financial Challenges

Editor’s note: Wendy is a financial advisor with three years of experience. She uses a scoring system called 360-HappiU to get customers to acknowledge and tackle their financial challenges.

How long have you been a financial advisor?

I joined at the height of the COVID-19 pandemic. I left my corporate job and became a financial advisor because I wanted to be on the ground to interact and help.

Do you use the financial satisfaction scoring system to support your customers?

Yes, every 1 in 2 of my customers would volunteer to score themselves on their financial satisfaction. Most of them explore retirement and saving as their financial priorities ….