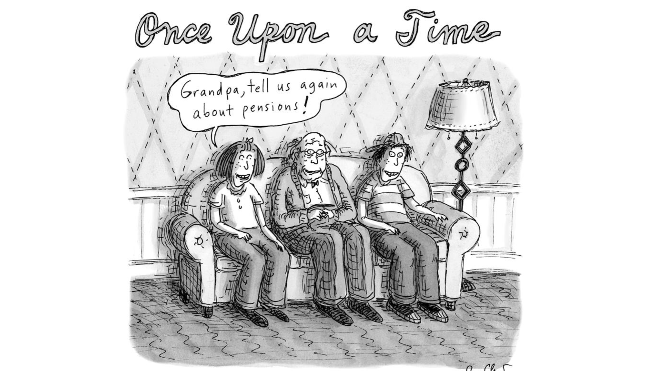

How Cheng Hao, A Financial Services Manager, Persuade Complacent Customers Successfully

Image source: Cartoonstock.com

Editor’s Note: Cheng Hao is a competent financial services manager who uses a scoring system called 360-HappiU® to persuade complacent customers.

What’s your experience in the advisory field?

I am a financial services manager with four years of experience. I enjoy grooming high achieving advisors, such as Court of Table (COT) and Million Dollar Round Table (MDRT) qualifiers (Editor’s note: COT qualifiers are the top 5% and MDRT qualifiers are the top 10% advisors in the industry).

Who are your customers?

I will have a pipeline of leads whom I will meet to review their portfolios. Many of them are in their twenties to thirties. Most of them have insurance coverage in some form.

What is one of your biggest challenges?

It is difficult to convince complacent customers as they usually underestimate the likelihood of a major illness happening to them ….

Investment servicing in a volatile stock market

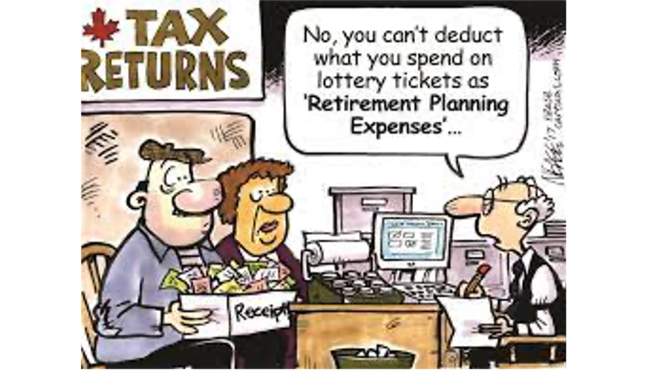

Image source: Cartoonstock.com

The stock markets are turbulent, again. Morningstar US Market Index reported a standard deviation of 13.2% for the last 12 months compared to 10.77% for 20211.

In the words of Rocky Balboa: The world ain’t all sunshine and rainbows. Yet as much as volatility is part and parcel of an investing journey, it is unnerving for customers.

Advisors have two options. Either they stay low and avoid customer queries or they step up actively to manage customer’s expectations and spot opportunities and risks for them ….

Watch A COT Member Yan Hui Integrate Storytelling With 360-HappiU®

Image source: Marketoonist.com

Editor’s note: Yan Hui is a 2021 Court of Table (COT) qualifier. To keep up her sales excellence, she combines her skills with tools. One of them is a scoring system, 360- HappiU®, which she complements with storytelling techniques.

Share with us how you use the scoring system with your customers.

My customers are often interested to know their score as it gives them an instant grasp of their future financial wellbeing. This makes it easy for me to build rapport with them. I also incorporate some storytelling techniques to bring the score to life ….

Meet Joven, A Financial Advisor Who Qualifies His Gen Z Prospects With 360-HappiU®

Image source: Marketoonist.com

Editor’s notes: Joven uses a scoring system called 360-HappiU® to size up his Gen Z prospects.

How long have you been a financial advisor?

Two years

Who are your prospects?

My prospects are like me, from the Gen Z population. They want to assert their freedom to decide, even if it is as simple as meeting me ….

How Singapore can materialize its commitment to

holistic financial advice

.. and lead the world by example

Image source: Tedgoff.com

To elevate the professionalism of the financial advisory services sector, the Insurance Culture & Conduct Steering Committee (ICCSC) in Singapore released a best-practice paper on 11 April 2022:

“Customers’ negative feedback often centres on the lack of follow-ups, regular servicing and policy reviews from their FA Rep (Financial Advisor Representative). Customers typically This has led to customers’ reduced trust in their FA Rep…”

Check the servicing box?

Regular servicing and reviews are important but so is the quality of such activities ….

Does your Quote-And-Illustration system delight the customer?

Image source: Cartoonstock.com

Notorious for being the weakest link in life insurance product development, the illustration system is however a largely untapped source of customer experience.

According to McKinsey analysis1, customer-first businesses benefit in terms of more cross-selling success and positive referrals, and less marketing spend required to drive growth.

Such benefits are in the customers’ best interest where cost savings reach a sustainable scale and passed back as reduced premiums, ultimately helping to close the persistent and global protection gap.

Among the many ways to embed customer centricity in a life insurer’s value chain, 360F seeks out the one that has the most far-reaching impact – the illustration system ….

How inflation affects your customers' HappiU

Image source: Cartoonstock.com

We live in inflationary times. Average inflation has hit a record 7.5% in Europe1. In the US, the Federal Reserve hurries to reduce its balance sheet by $95 billion a month, tightening monetary policy to curtail the overshooting inflation2. Singapore, where 360F is headquartered, has experienced a near doubling of headline inflation3.

Trigger the servicing!

With rising prices, the customer’s purchasing power diminishes ….

The hardest people to sell to is family. Until a financial advisor used-360-HappiU®

Image source: Cartoonstock.com

Editor’s Note: Derwin is a newly minted financial advisor who uses a scoring system called 360-HappiU® to build trust with his family members.

How long have you been a financial advisor?

I joined the financial advisory industry last year, so I’m still relatively new to the advisory scene.

Which group of people do you find the hardest to reach out to?

The hardest group of people to reach out to is actually my family members, especially my relatives. They are very unwilling to share financial information with me so starting a conversation about financial planning is challenging ….

How 360F Tackles Behavioural Biases For Your Customer's Best Interests

Image source: Cagel.com

In Part 1 of the Behavioural Bias series, we address loss aversion and optimism biases, explaining how we manage them actively in our financial advisory applications.

In this follow-up article, we tackle another two biases, overconfidence and mental accounting, that we weed out as part of our optimization work for the customer’s financial well-being.

The Overconfidence Effect

Humans are terrible at judging probabilities. This incompetency triggers a couple of biases including the loss aversion bias, optimism bias and in no lesser degree, the overconfidence effect ….

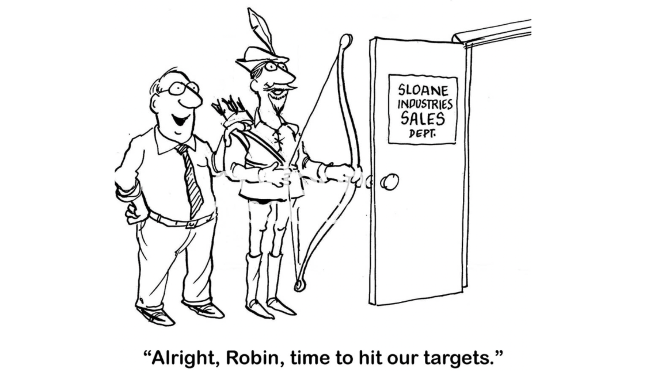

How Dennis, an upcoming Financial Services Manager uses 360-HappiU® to recruit and empower new advisors

Image source: Andrew Grossman, Cartoonresource.com

Editor’s notes: Dennis is an upcoming Financial Services Manager who leverages a scoring tool and system called 360-HappiU® to initiate and empower new advisors.

What are some of the demographic profiles of your incoming advisors?

Most of them are in the range of early twenties to mid-thirties. I pick this age range as I understand how to engage them.

How do you use the scoring system to support your advisor recruitment?

The scoring system makes things intuitive. My prospect advisors can envision themselves using the system easily. The scoring system can be used to pre-engage the client prospects – this is especially useful for new advisors who are intimidated by the idea of a sales appointment ….