The Day of a productive Financial Advisory Professional

David is a financial advisor. While his peers begin their day with cold calling and emailing the latest product campaigns, David invites his prospects to complete a simplified financial self-discovery exercise at their own pace. David pre-empts them that the exercise gifts them a scoring mechanism that measures their likely financial satisfaction in the hope of achieving future financial independence.

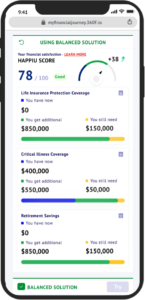

The score calculated by the mechanism, is known as the HappiU. It is a transparent metric that reflects the prospect’s ability to weather through a financial crisis like critical illness and yet achieve his/her financial goals. It also measures the impact of any suggested financial advice.

The HappiU score is central to trust building in the advisory relationship. Just like how the navigation software enables us to trust strangers to bring us to our destination in their private hire cars, the HappiU score ensures both the prospect and the advisor share the same referencing system that is intuitively and mutually understandable. A prospect empowered to understand and discuss his current net worth and financial gaps is one who will develop buyer intent to improve his situation. Buyer intent fuels the advisor’s interaction with the customer. The stronger the intent, the easier it is for advisor to engage the prospect productively and bring customer satisfaction.

David’s day has a good start and gets even better. The self-discovery exercise generates a bundle of personalized and recommended insurance plans, and showcases how these insurance policies can improve the prospect’s HappiU score. This self-directed functionality gives prospects a sense of control. Unlike the boomer generation who readily accepts the expert authority of the financial advisor, the current millennial generation resists the monologue of information transfer from their financial advisors. By guiding prospects to discover the information and enabling them to understand it, advisors find themselves in an effective collaboration with their prospects to reach a consensus easily. The self-discovery financial exercise has not only empowered the prospect but also David to save the time which would otherwise be wasted on overcoming objections from prospects who have yet to develop any buyer intent.

Most customers want to be included in the decision-making but few will want to venture alone. David now spends most of his day guiding his prospects through the sales process. Seeing is believing but in the world of financial advice, advisors and prospects must grapple with unforeseen events. However, David has a visual financial simulator at his disposal, a powerful and credible foresight tool that analyzes and visualizes the prospect’s personal and market risks based on probability to project the lifetime net wealth. Using the tool, David demonstrates how the recommended insurance solutions enables the prospect to cope with bad times and achieve his defined financial goal of financial independence.

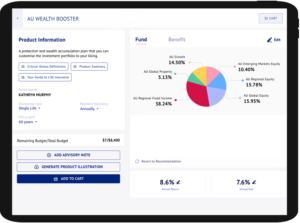

On some days, David encounters prospects whose true concerns surface only during an in-person or the insurance sales process. David is free to modify the recommendation options generated in the self-discovery exercise. Staying on the same platform, he customizes the solutions – from comparing different insurance and investment features in a single view, to configuring the individual insurance policies and simulating their impact on the prospect’s financial satisfaction. Also, he can take in his prospect’s special requirements such as Environmental, Social, and (Corporate) Governance (ESG) preferences and customize an optimal investment portfolio. As the platform helps David to stay within reasonable assumptions and suitability rules, he minimizes the chances of having to re-work his proposals or getting flagged for compliance issues during audits.

Supported by robust and intuitive automation tools, David relishes his career as a financial advisor. His sales success is sustainable. He enjoys interacting with his prospects and customers and the best part – the feeling is mutual.

Discuss more?

Drop us an eMail here: clarie.kwa@360f.com

Why are Financial Advisors so stressed?

I’ve been a financial advisor for two years. Financial advisory is an enriching journey, and every job has varying stress, but this is different. The stress was clearly reflected in my lack of sleep and weight gain (ten kilos, to be exact). Financial advisors are highly stressed than other professionals but why is that so?

Jack of all trades

The financial advisor wears multiple hats in this job. From the onset, he is the lead generator, marketer, salesman and servicing personnel all in one. Most come into the job not knowing how to do any of these. The initial learning curve is hence very steep. Coupled with the pressure to break the egg, the journey proves to be more overwhelming than expected.

Do we really expect the average financial advisor to be savvy with product differentiation and product knowledge and sell these products, right after a two-month crash course? What about investment market trends? Speaking of sales, is the advisor then really advising or selling? Compounding these issues with management KPIs makes advisor’s role challenging.

“Give us this day our daily dough.”

Most advisors are remunerated on a commission-basis. Before you imagine a huge pipeline of customers and a fat bank account, think again. Sales is cyclical meaning there will be good and bad months. Without a basic salary and consistent sales, this leads to an unstable income with physical needs on the line. Will this be solved by merely securing more appointments? Is it sustainable? Unlikely.

Many advisors start off by reaching out to their social circle, known as their warm market. At some point, they will exhaust their warm leads and reach out to the cold market. Cold-calling and canvassing are common prospecting ways which are notoriously ineffective. Reckon this: will you actually entrust your money to a stranger whom you’ve met for barely five minutes?

In developed markets like Singapore, insurers are constantly competing for a bigger share in a market where most people would have basic insurance coverage. The struggle then involves up-selling products on top of what most people already have, blurring the line between boosting one’s financial portfolio and mis-selling. This is a potential compliance risk where advisors can face ethical conundrums here.

In general, many have a subconscious aversion towards advisors since people are typically wary towards sales personnel, making advisors even more desperate. The end result? A stigmatized industry. We perceive financial advisors as pushy, and unscrupulous because these traits are fairly common even as obnoxious and aggressive sales tactics prevail.

Flexing is abs-olutely uncool

Familiar with “successful” advisors flashing their BMWs and Rolexes on social media? All these flexing is part of personal branding and wrongly assumes that trust is given because of the advisor’s “success”. However, this success is only defined superficially and materially which kills relational trust. The ultimate question begs to be asked:

“Is the advisor selling this because I need it or am I merely enabling his flexing?”

Using successful consultants as role-models to emulate, insurers often dangle ridiculous wealth before success-hungry advisors as an attainable goal. For most people, this is a lie. By juxtaposing these elusive ambitions with present reality, the discrepancy can cause one to be self-beating and perpetuate the desperation-hard sell-rejection cycle.

The double blue tick

Rejection is the advisor’s old-time friend. While it can build resilience, perpetual rejection can be hurtful and damaging for the advisor over the long run. Rejection from a loved one is harder and can be isolating. Detached and labelled, how can the average advisor build trust and bring in the sales? With this emotional tension, no wonder advisors are so stressed.

Finally, don’t cast the first stone

If you meet an advisor, try to be kind. The bad rep is understandable but restrain from casting the first stone. Everyone has their battles to fight, even them. With some luck and discernment, you will find an advisor who truly cares for you and your needs.

Discuss more?

Drop us an eMail here: clarie.kwa@360f.com