The Open Secret to Longevity and the Next Proposition for Insurers

Image source: Financial Times

My grandmother passed away two weeks ago. She was 102.

Centenarians like my grandmother are becoming more common. The United Nations expected, in 2021, over half a million people living over 100 worldwide[1].

Longevity offers the chance to experience and share the many meaningful experiences of a long life. On her 101st birthday, my grandmother was still mentally alert and carried one of her ten great-grandchildren, a rather beefy one, on her lap. At least three wellness factors, interdependent among each other, make longevity a blessing – physical, mental, and financial….

How A Financial Advisor Strategized His Prospect's Retirement Planning Using 360-HappiU®

Image source: Glasbergen.com

Editor’s note: Jimmy is a financial advisor who used 360-HappiU®, a financial satisfaction scoring tool, to engage commitment-averse prospects and instil the urgency in them.

Tell us three things about you as a financial advisor.

I am a 55-year old retiree. I joined the financial advisory industry two years ago. My customers and prospects tend to be between 30 and 50 years old.

What are your prospects’ typical financial struggles?

Their greatest fear is job security, especially as they hear the recent bad news about the economy. They are cognizant of the threat to their income and cash flow and ultimately, their retirement. Ironically the same concern makes them fearful of committing to a regular savings or retirement plan ….

How We Help Your Customers Overcome A Four-Decade High Inflation

Image source: Yahoo.com

On 13th July 2022, the US consumer price index reported a four-decade high inflation rate of 9.1%, prompting a large interest hike by the Federal Reserve to tame the surging inflation rate1.

Servicing is about active pre-emption

Inflation diminishes people’s purchasing power and threatens their income stability at the same time. Financial advisors play the critical role in helping their customers foresee and shield the impact on their financial aspirations and protection needs, i.e., their future financial satisfaction.

Denise’ HappiU score fell by five points when long-term inflation rate doubled from 2 to 4%.

Denise is a 27-year-old professional earning above the market benchmark. She is a good saver too, as she aspires for an early but reasonable retirement ….

Help Customers Trust Themselves To Enhance Customer Satisfaction

Image source: Google Groups

In “The Geneva Papers on Risk and Insurance” published this year, Eckert, Neunsinger and Osterrieder showed through the lens of digital transformation possibilities, the opportunities to raise customer satisfaction1, in areas including insurance services, insurance transactions, and the relationship with the insurance company2.

360F enables insurers to enhance customer satisfaction by enabling customers to trust that they are doing the “right thing” for themselves.

Customer profiling and segmentation

The paper noted that customer profiling and segmentations enables insurers to predict and steer product demand while identifying customer segments with high purchase intent1. 360F’s predictive analytics service, 360-NeedsProfiler®, fulfils both outcomes by anticipating the customer’s most important financial need and creating the intent, even for the passer-by. Not only do the customers better understand themselves, the service gives insurers the insight to personalize their remarketing efforts and provide tailored content ….

How 360-HappiU® Supports Inclusion With The Deaf Community

Editor’s note: Victor has been hearing impaired since birth. He shares his financial planning journey with 360F, especially on how 360F’s scoring tool, 360-HappiU® can support disability inclusion.

Thank you for accepting the interview. Could you introduce yourself to our readers?

I am 28 years old and currently working full time in marketing. I suffered from deafness since young. While I have faced challenges with audio communication, it has made me highly independent as I seek to take control over my finances.

How does your disability affect the way you plan your finances?

My hearing loss makes employability and career prospects challenging. Hence I must be very clear of my financial goals and set realistic action steps to fulfil them. In the earlier years, however, financial planning information and guidance were not readily accessible, so I had to rely heavily on my financial advisor(s) to track my progress ….

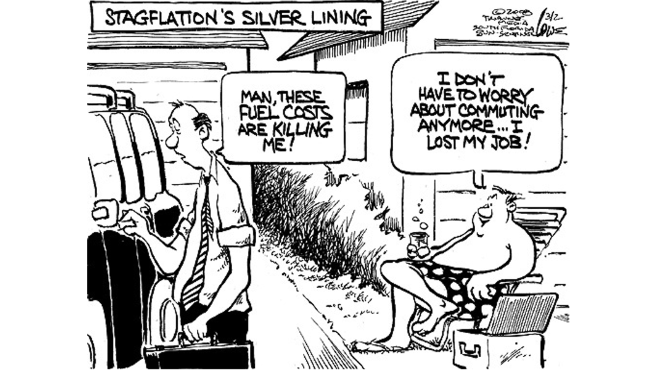

How We Help Your Customers Overcome The Risks Of Stagflation

Image source: Sliderbase.com

The World Bank recently warned that stagflation risk is on the rise globally, a trend that would potentially push nations into recessions.

The warning was not unexpected. Inflation has reached new highs, pervading the rich and poor nations, from energy prices to animal feed and alternative meats1. The same drivers of the current inflation decelerate the global economic growth, hurting companies’ profits and triggering layoffs ….

How A Financial Advisor Uses 360-HappiU® To Overcome A Prospect's Skepticism

Image source: Cartoonstock.com

Editor’s note: Xinfei is a financial advisor who uses a financial satisfaction scoring system called 360-HappiU® to overcome a prospect’s skepticism

What are some of the struggles you face?

I find it challenging to set in place a system to prospect and engage my customers. Recently, my company introduced a financial satisfaction scoring system within a simplified financial review. It turned out to be an effective prospecting system for me. Best of all, I find it simple and easy to stick to.

How did your customers and prospects find it?

They found it refreshing as they have never reviewed their finances in this manner before. One of them even sent me a screenshot of her financial satisfaction score and appreciated how intuitive it was to understand ….

How We Help Advisors Make Servicing

Meaningful And Profitable

Image source: Marketoonist.com

In Singapore, the Insurance Culture & Conduct Steering Committee wants to cultivate the financial advisory representatives (FA Reps)’ servicing mindset:

“The value proposition of FA Reps should go beyond product advice and recommendations. Ongoing review of the suitability of the financial plan and product effectiveness in meeting the customer needs is an important element of financial planning as their needs change over time. Hence ICCSC also recommends that FAFs require their FA Reps to provide ongoing servicing of customers to review their financial plans..1”

Consistent and competent post-sales servicing gives customers the assurance that the advisors put their needs at the forefront. This enables advisors to enjoy 3 to 4 times better conversion on existing customers than prospects2.

How we help Don, a financial adviser with 150 customers

Don has a customer base largely concentrated in life and health protection and savings. Other than the occasional policy claims, servicing has been generally uneventful.

How Cheng Hao, A Financial Services Manager, Persuade Complacent Customers Successfully

Image source: Cartoonstock.com

Editor’s Note: Cheng Hao is a competent financial services manager who uses a scoring system called 360-HappiU® to persuade complacent customers.

What’s your experience in the advisory field?

I am a financial services manager with four years of experience. I enjoy grooming high achieving advisors, such as Court of Table (COT) and Million Dollar Round Table (MDRT) qualifiers (Editor’s note: COT qualifiers are the top 5% and MDRT qualifiers are the top 10% advisors in the industry).

Who are your customers?

I will have a pipeline of leads whom I will meet to review their portfolios. Many of them are in their twenties to thirties. Most of them have insurance coverage in some form.

What is one of your biggest challenges?

It is difficult to convince complacent customers as they usually underestimate the likelihood of a major illness happening to them ….

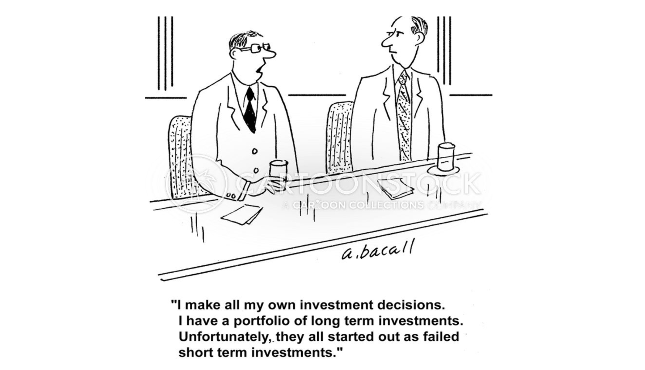

Investment servicing in a volatile stock market

Image source: Cartoonstock.com

The stock markets are turbulent, again. Morningstar US Market Index reported a standard deviation of 13.2% for the last 12 months compared to 10.77% for 20211.

In the words of Rocky Balboa: The world ain’t all sunshine and rainbows. Yet as much as volatility is part and parcel of an investing journey, it is unnerving for customers.

Advisors have two options. Either they stay low and avoid customer queries or they step up actively to manage customer’s expectations and spot opportunities and risks for them ….